Banks and credit unions alike benefit from having a solution in place that detects and addresses issues before they affect application performance, impact end-users, or interrupt solution functionality and operational efficiency. ARGO Early Detection Monitoring Service (EDMS) does just that.

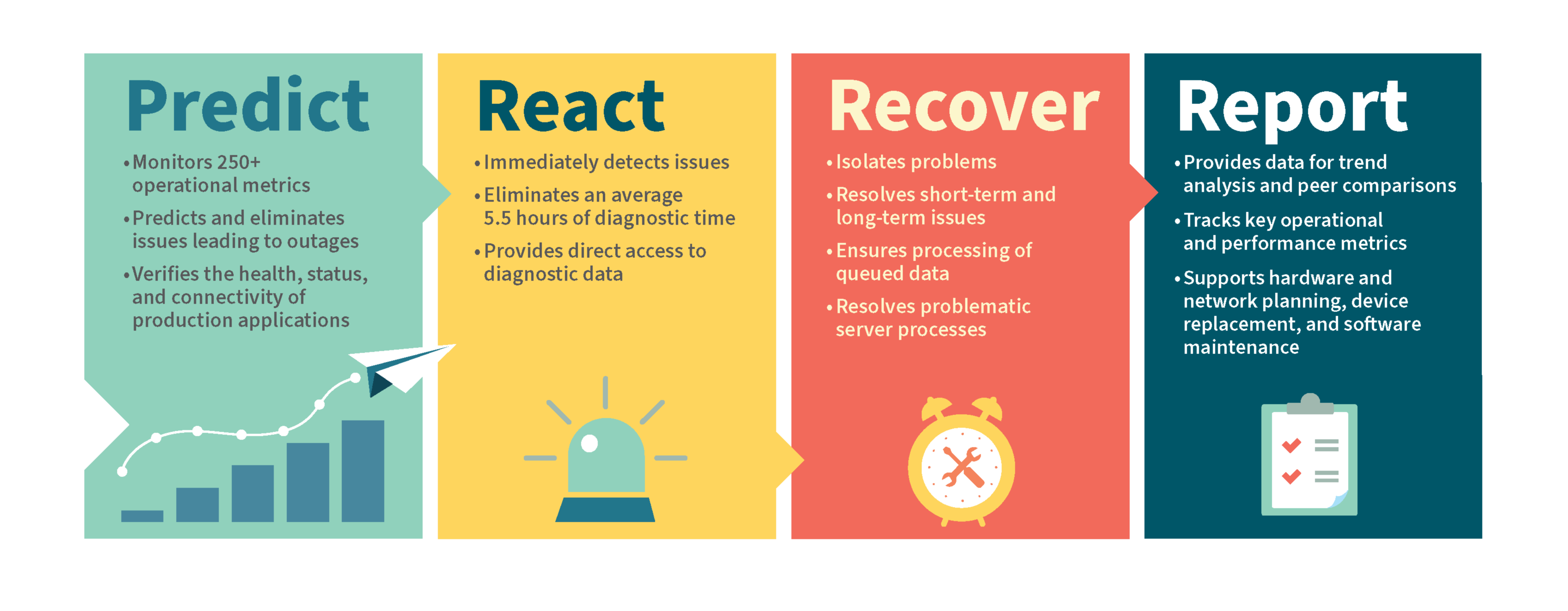

Financial institutions that leverage EDMS proactively detect and address potential issues within mission-critical operations before they occur. EDMS monitors more than 250 operational metrics in real time to predict and eliminate issues potentially leading to outages; provide users with direct access to diagnostic data; isolate and resolve short-term and long-term issues along with problematic server processes; and provide reporting data for trend analysis and peer comparisons.

In 2020, ARGO EDMS monitored and analyzed more than 65 million transactional requests daily and reviewed more than 250 risk-point KPIs. It also monitored more than 103,000 desktops nationally, maintained an average response time of 0.19 seconds for the 15.5 billion transactional requests, reported more than 155 high and medium severity incidents and successfully prevented more than 117,000 hours of desktop outages and lost productivity for organizations using the service. As a result, ARGO customers experienced 99.998 percent uptime availability in their middle-tier servers.

This past year saw a tremendous increase in devices and applications added to networks and infrastructures, which in turn increased the potential of unforeseen issues, outages and interruptions in service. Even with the shift to more remote computing, organizations utilizing the solution realized consistent results with EDMS proactive monitoring of their operations, ensuring maximum reliability and uptime.

For more information about ARGO EDMS, download the 2020 results report.